Modernizing Service Experiences in Financial Institutions

Empowering financial institutions to provide seamless, transparent and customer focused service experiences.

Efficient Queue and Appointment Solutions for Finance

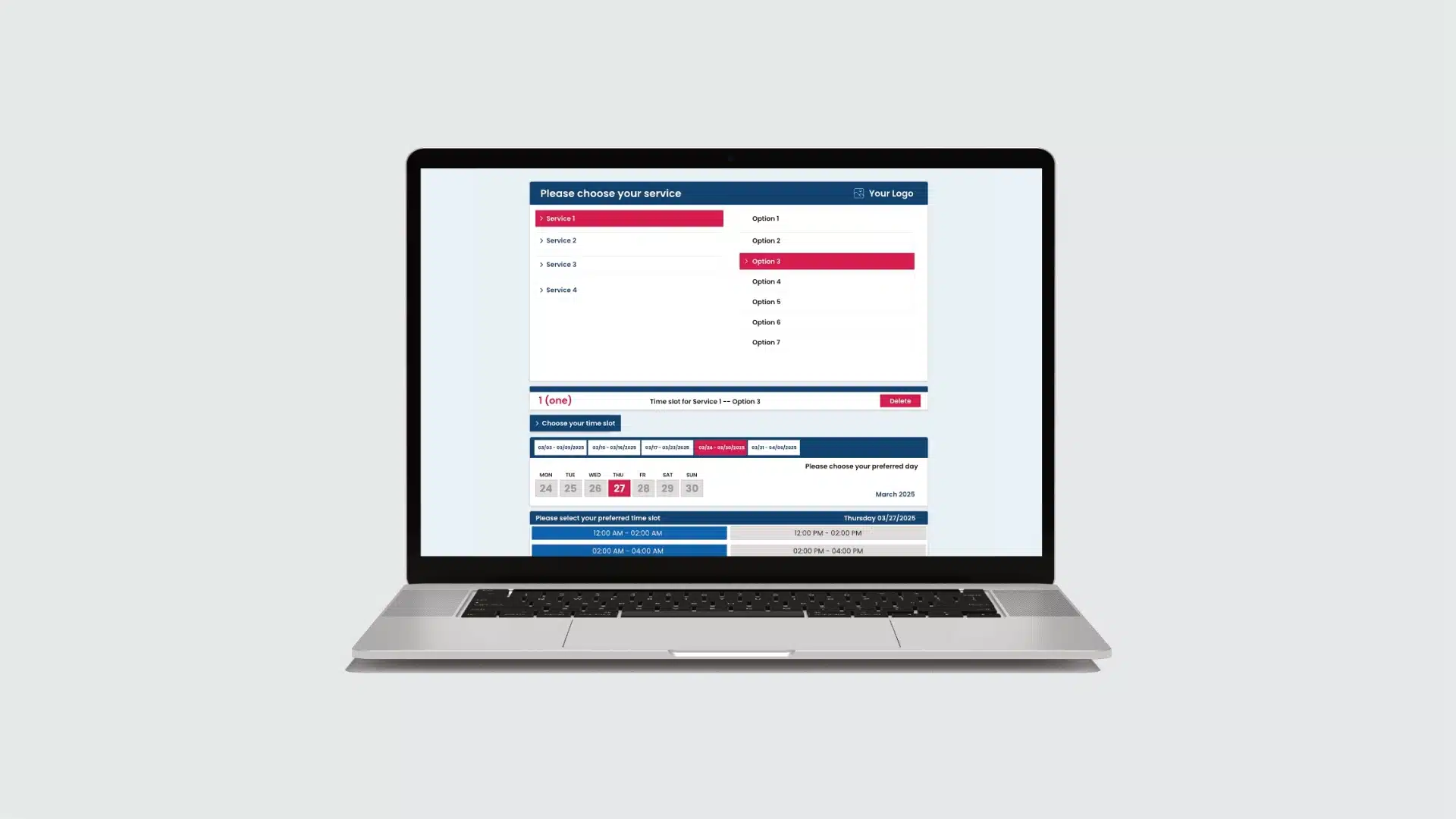

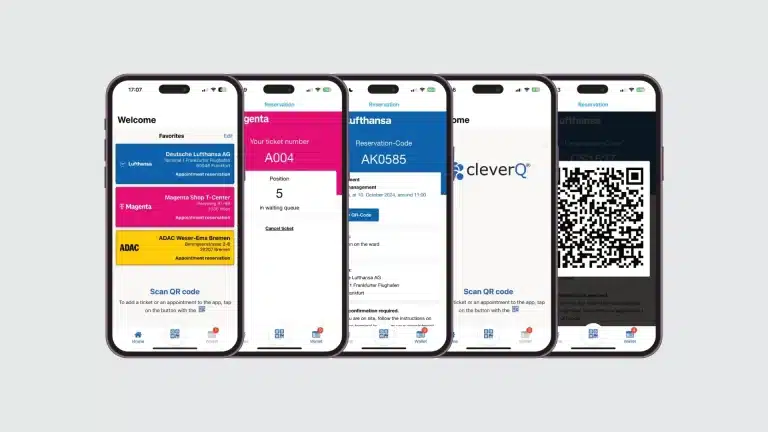

Online and Mobile Booking: Clients can easily schedule appointments through the cleverQ app, website, or phone. This simplifies the appointment process, reduces administrative tasks, and enhances client satisfaction. Automated Reminders: cleverQ sends automated reminders to clients, reducing missed appointments and improving the overall efficiency of service delivery.

Virtual Queuing and Real-Time Updates

Streamlined Check-In Process

Improved Service Delivery

Enhanced Internal Communication

Data Analytics and Insights

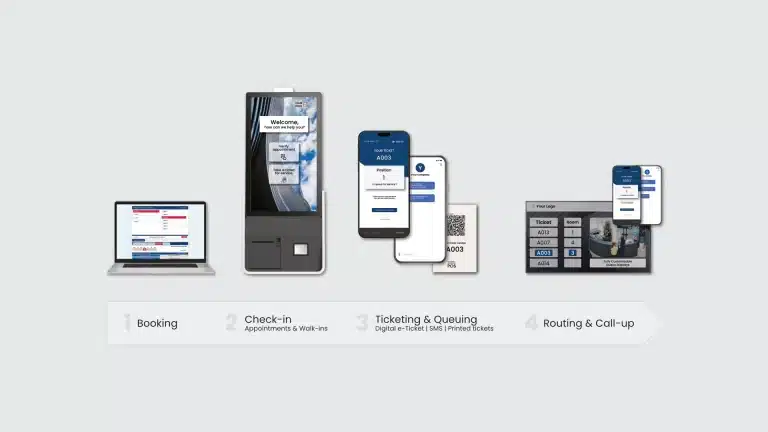

Solutions That Power Your Service Journey

cleverQ provides a set of core solutions designed to improve every step of your service process. Whether you need digital queue management, online appointment scheduling or flexible ticketing options, each module enhances efficiency, reduces waiting times and creates a better experience for customers and staff. Explore our solutions.

API Integration

Process automation:

The cleverQ API enables the automation of processes such as scheduling, queue management and notifications. Companies can create custom workflows to meet their specific requirements and reduce manual tasks, resulting in improved efficiency and productivity.

Improve the customer experience:

By integrating the cleverQ API into existing customer service or appointment management systems, businesses can provide an enhanced customer experience. Customers can conveniently book and manage appointments through familiar platforms, resulting in a seamless and user-friendly interaction.

Data integration and analysis:

By integrating the cleverQ API with other enterprise systems, data can be seamlessly exchanged and analyzed. This enables companies to gain comprehensive insights into their customer and operational data and make informed decisions to optimize and improve their business.

Our trained staff will be happy to answer any questions you may have about our products and services. Our sales team will be happy to provide you with non-binding offers for our portfolio. Simply get in touch with us.